How to Create Bilingual Invoices in TallyPrime for UAE Businesses

Learn how UAE businesses can create Arabic and English bilingual invoices in Tally Prime for clearer communication and smoother VAT compliant invoicing.

A common invoicing challenge in the UAE

Many businesses in the UAE deal with a mixed audience every day.

- Local customers who prefer Arabic

- International customers who expect English

- Internal teams who work in English

- Authorities who expect Arabic clarity

While English invoices are widely used, Arabic visibility on invoices is important in the UAE, especially for:

- Government related customers

- Arabic speaking clients

- VAT audits and document verification

- Professional and compliant brand image

This is why many UAE businesses choose bilingual invoices, where Arabic and English appear on the same invoice.

Tally Prime supports this requirement, but many users do not know how to set it up correctly.

What is a bilingual invoice in simple words

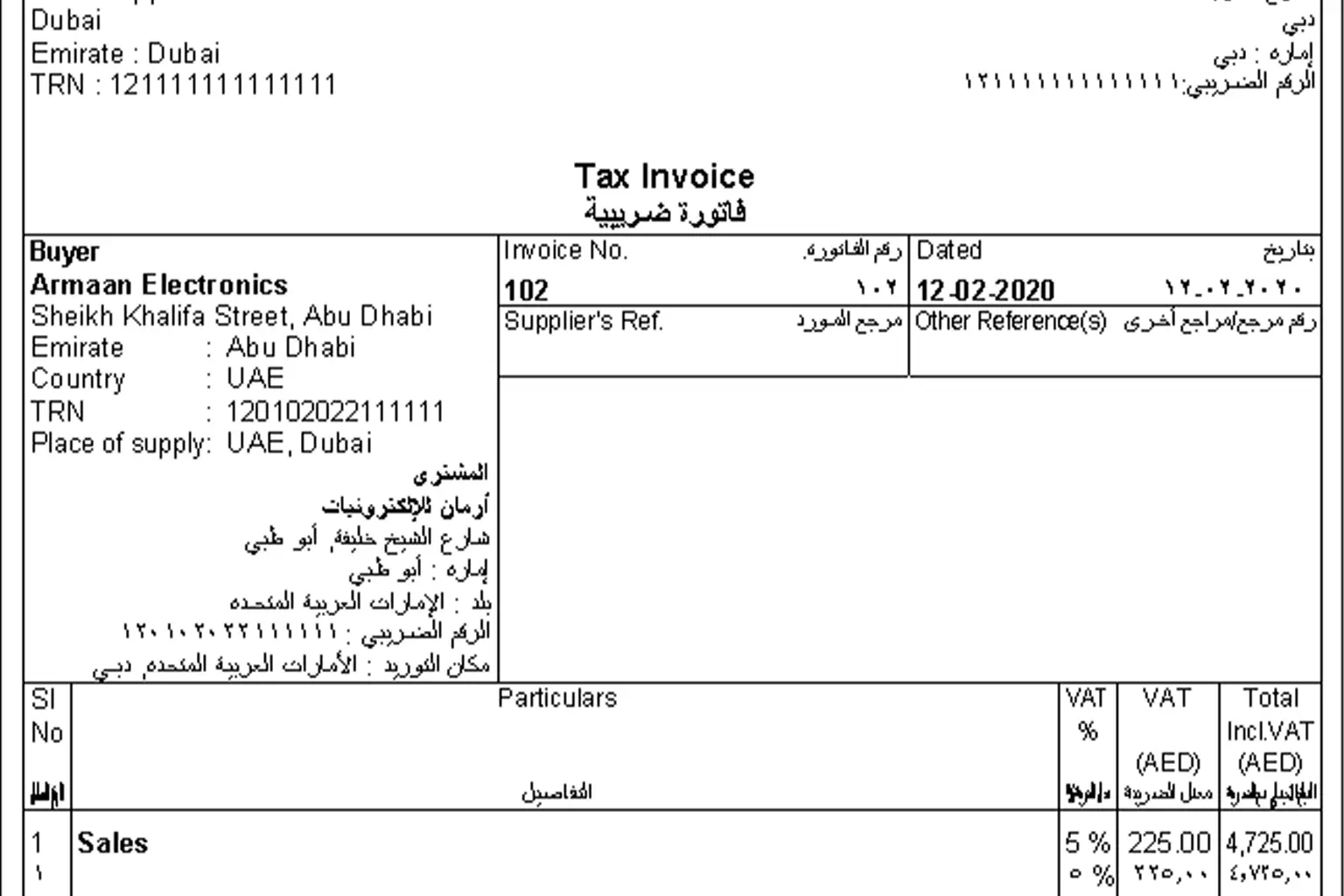

A bilingual invoice is a single invoice that shows details in both English and Arabic.

Usually, it includes:

- Company name and address in Arabic and English

- Customer name in both languages

- Item or service names in both languages

- VAT details clearly visible

- Amounts printed properly

This helps everyone read the same document without confusion.

In the UAE, bilingual invoices are not mandatory for all businesses, but they are strongly recommended for clarity, professionalism, and future compliance needs.

How UAE businesses actually use bilingual invoices

Let us look at a practical UAE example.

A Dubai based trading company:

- Sells to local UAE customers

- Supplies to government entities

- Works with overseas suppliers

Internally, accounts staff work in English.

Customers prefer Arabic invoices.

By using bilingual invoices in Tally Prime:

- Sales team issues one clear invoice

- Accounts team avoids duplicate documents

- VAT details remain consistent

- Customers understand invoices better

No separate Arabic invoice.

No manual translation.

No confusion.

Benefits of bilingual invoices for UAE businesses

Using bilingual invoices gives practical advantages, not just compliance.

- Improves clarity for Arabic and English readers

- Reduces disputes caused by misunderstanding

- Helps during VAT inspections and audits

- Builds trust with local customers

- Looks professional and organised

- Supports smooth internal communication

- Avoids rework and manual corrections

- Strengthens brand credibility in the UAE market

How Tally Prime supports bilingual invoicing

Tally Prime allows you to:

- Enter company details in Arabic

- Add Arabic names for customers and items

- Print invoices in English, Arabic, or bilingual

- Show VAT details clearly

- Save invoices as PDF files

Once set up, daily invoicing becomes very simple.

Step by step guide to create bilingual invoices in Tally Prime for UAE

Step 1: Enable local language support

Go to:

Gateway of Tally

Press F11 Features

Enable:

- Local language support

- Mailing details in local language

Save the settings.

Step 2: Enter company details in Arabic

Open:

Company alteration screen

Enter:

- Company name in Arabic

- Address in Arabic

- Emirate or region in Arabic

Save using Ctrl + A.

This ensures your invoice header appears correctly in bilingual format.

Step 3: Add Arabic names for customers and suppliers

Go to:

Gateway of Tally → Alter → Ledger

Open a customer ledger.

- Enable language alias for names

- Select Arabic language

- Enter customer name in Arabic

- Enter address details in Arabic if required

Save the ledger.

Repeat this for customers, suppliers, and cash or bank ledgers if needed.

Step 4: Add Arabic names for stock items or services

Go to:

Gateway of Tally → Alter → Stock Item

- Enable language alias

- Select Arabic

- Enter item name in Arabic

Save the item.

This step is important for trading and retail businesses.

Step 5: Configure invoice printing settings

Create or open a sales invoice.

Press:

Ctrl + P to print

Then press C to configure

- Invoice format: Simple or Commercial

- Print type: Bilingual

- Show amount in words in Arabic: Yes

- Show numerals in Arabic: Optional

- Footer message in Arabic if required

Save the configuration.

Step 6: Preview and print the invoice

Press I to preview or P to print.

Choose PDF printer and save the invoice.

Your invoice will now show Arabic and English together.

UAE VAT and bilingual invoices

Bilingual invoices do not change VAT calculation.

- VAT rate

- VAT amount

- TRN display

- VAT breakdown

They help during VAT audits, customer verification, and document checks.

Authorities can clearly read invoice details without translation.

Common mistakes UAE users make

- Arabic language enabled but no Arabic names entered

- Only company name translated, not items

- Using bilingual print without checking preview

- Mixing Arabic numerals unintentionally

- Forgetting to save configuration settings

- Assuming bilingual invoices affect VAT logic

Bilingual invoices affect presentation, not calculation.

When you should use bilingual invoices, and when you may not

You should use bilingual invoices if:

- You serve Arabic speaking customers

- You work with government or semi government entities

- You want a professional UAE compliant image

- You want fewer invoice disputes

You may not need them if:

- All customers accept English invoices

- Business is fully international

- No Arabic requirement from clients

Even then, preparing for bilingual invoicing is future safe.

Final advice for UAE businesses

Bilingual invoices are not about complexity.

They are about clarity and professionalism.

Once the setup is done in Tally Prime, daily invoicing takes the same time as before.

If you need help setting up bilingual invoices correctly or e-Invoice for your UAE business, the Tally Mena support team can assist and ensure everything is aligned with your invoicing and VAT requirements.