Master Tally Prime: Your Ultimate Guide to Efficient Accounting

Unlock the full potential of Tally Prime with our comprehensive guide. Streamline your accounting and manage finances effortlessly like a pro!

Key Features of Tally Prime for UAE Accountants

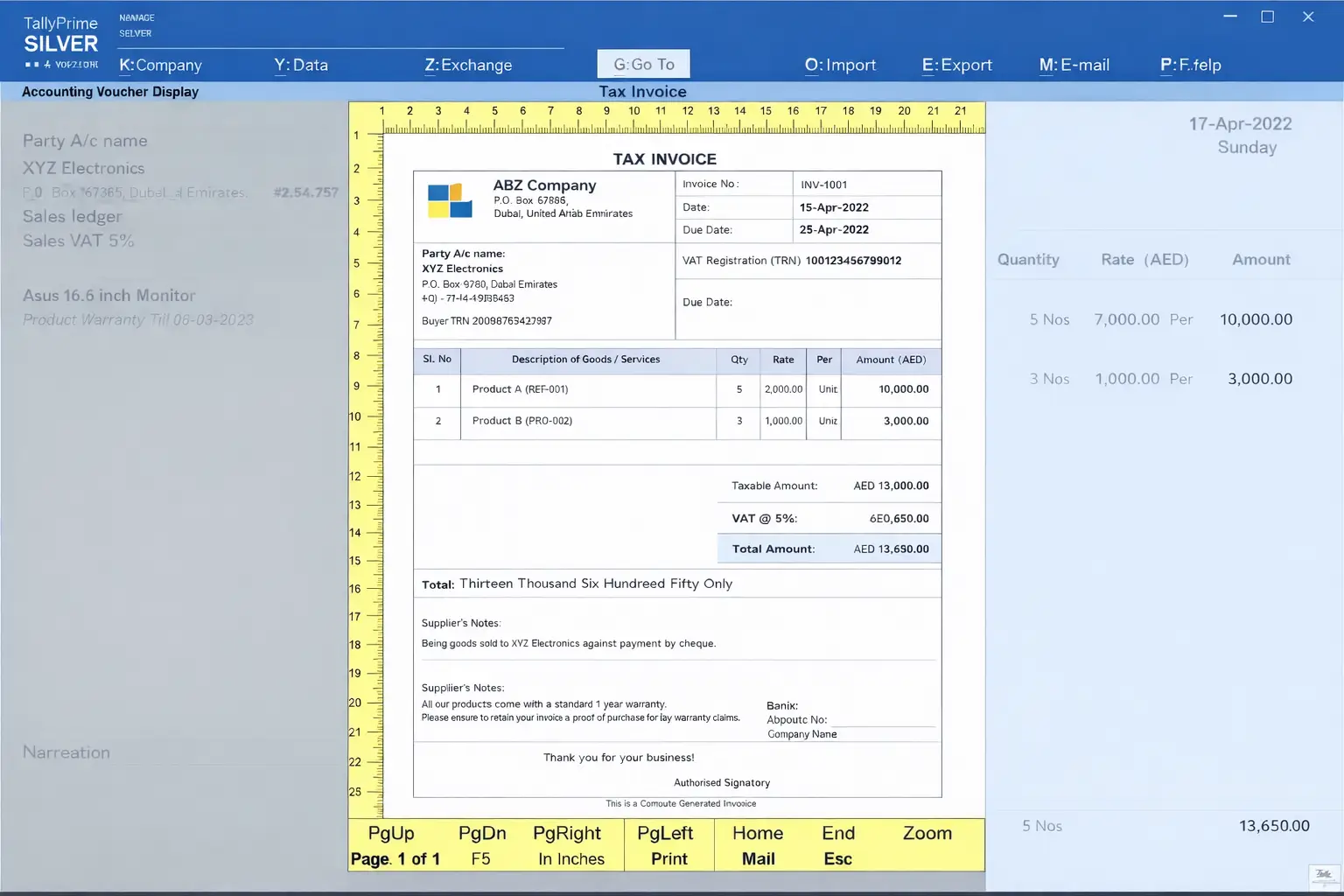

Tally Prime is the current flagship accounting software from Tally Solutions and is widely used by businesses across the UAE. It is designed to meet daily accounting needs while supporting UAE VAT compliance, audit readiness, and accurate financial reporting.

One of the strongest advantages of TallyPrime is its simplicity. The interface is clean, consistent, and easy to understand, even for junior accountants or business owners with basic accounting knowledge. Unlike complex ERP systems, Tally Prime allows users to focus on accounting tasks without unnecessary screens or steps.

For UAE accountants handling multiple clients, speed and accuracy are critical. Tally Prime supports fast data entry, logical voucher structures, and real time validation, which helps reduce posting errors and saves time during month end closing.

Another major feature is its strong inventory management system. Businesses in the UAE often deal with imports, exports, and fast moving stock. Tally Prime allows real time stock tracking, item wise valuation, and purchase and sales linkage, which is essential for trading companies, retail stores, and distributors.

Tally Prime also supports batch wise tracking and expiry date management. This is particularly useful for sectors such as food trading, pharmaceuticals, FMCG, and spare parts, where expiry control and batch identification are mandatory for compliance and quality control.

Setting Up Tally Prime for UAE Businesses

Setting up Tally Prime correctly at the beginning is crucial for long term accuracy and compliance. The software should always be downloaded from the official Tally Solutions website to ensure authenticity and access to updates.

After installation, license activation is done using a Tally.NET ID. This activation allows access to statutory updates, VAT configurations, and connected services. For UAE businesses, it is important to keep the license active to receive VAT related updates issued by Tally.

Once activated, the company creation process begins. During this step, accountants must carefully select the financial year and enable VAT under statutory features. UAE VAT registration number, VAT start date, and reporting period must be entered correctly to ensure accurate VAT returns.

Tally Prime allows configuration based on business type. Trading, manufacturing, and service businesses can customize ledgers, stock groups, voucher types, and taxation rules. Proper setup at this stage helps avoid errors during VAT filing and audit reviews later.

Security settings should also be enabled. Tally Prime supports user level access control, which is important in UAE companies where accounts staff, auditors, and management access the same data with different permissions.

Understanding the Tally Prime Interface

The Tally Prime interface is built around efficiency. When you open the software, the Gateway of Tally acts as the central dashboard. From here, users can access accounting, inventory, payroll, banking, and reporting functions without navigating deep menus.

The top menu provides quick access to create, alter, and display options. This structure helps accountants work faster during busy periods such as VAT return preparation or year end closing.

The button bar on the right side dynamically changes based on the screen you are working on. This context based design reduces confusion and ensures that only relevant actions are shown.

At the bottom of the screen, the information panel displays important details such as company name, current period, and system status. It also shows alerts related to incomplete vouchers or configuration issues, which helps accountants identify problems early.

Core Accounting Functions Used in the UAE

Ledger management is the backbone of accounting in Tally Prime. UAE accountants typically create ledgers for sales, purchases, expenses, VAT control accounts, and bank accounts. Each ledger can be linked with the correct VAT rate, ensuring automatic tax calculation.

Voucher entry in Tally Prime follows standard accounting practices. Sales vouchers, purchase vouchers, receipt vouchers, and payment vouchers are structured to match real business transactions. This makes it easier to train junior staff and maintain consistency across accounts.

Bank reconciliation is especially important in the UAE, where businesses use multiple bank accounts and payment modes. Tally Prime allows bank statement import and reconciliation, helping accountants match ledger balances with bank records accurately.

This feature is critical for audit readiness and helps identify missing entries, duplicate postings, or bank charges that need adjustment.

Inventory Management in Tally Prime

Inventory management in Tally Prime is tightly integrated with accounting. Every purchase and sale directly affects stock levels and financial records, which reduces mismatch between accounts and inventory.

Stock items can be created with units of measurement, item codes, and grouping. This structure helps businesses manage large product catalogs efficiently.

Batch tracking and expiry date features are widely used by UAE trading companies. These tools help businesses comply with internal quality standards and avoid losses due to expired or unsellable stock.

Stock valuation methods such as FIFO and weighted average are supported. UAE accountants usually select valuation methods based on audit requirements and business policy. Consistency in valuation is important for financial reporting and audit compliance.

Reporting and Financial Analysis

Tally Prime provides detailed financial reports that are essential for UAE businesses. Balance sheets, profit and loss statements, and cash flow reports are available in real time.

These reports help business owners and finance managers understand profitability, liquidity, and cash position without waiting for month end summaries.

VAT reports are one of the most used features in the UAE. Tally Prime generates VAT summaries, transaction level VAT details, and return ready reports that match UAE Federal Tax Authority requirements.

Management reports such as sales analysis, purchase analysis, and outstanding receivables help accountants advise management on performance and risk areas.

Ratio analysis and trend comparison features allow accountants to review financial health over multiple periods. This is useful for budgeting, forecasting, and strategic planning.

Practical Tips to Improve Efficiency in Tally Prime

Keyboard shortcuts play a major role in improving productivity. UAE accounting firms that handle multiple clients rely heavily on shortcuts for faster data entry and navigation.

Customizing reports and vouchers helps remove unnecessary fields and focus only on required information. This is especially useful during VAT filing and audit preparation.

Recurring vouchers can be used for regular expenses such as rent, utilities, and service charges. This reduces repetitive work and ensures consistency in monthly postings.

Regular data backup is critical. UAE businesses should maintain daily or weekly backups to avoid data loss due to system failure or human error.

Handling Common Tally Prime Issues

Data corruption can occur due to improper shutdowns or power issues. Tally Prime includes built in data repair and rewrite options to resolve such issues.

Performance issues are often related to large data size or insufficient system resources. Periodic data optimization and system upgrades help maintain smooth operation.

In multi user environments, network configuration must be stable. Proper firewall settings and server access ensure uninterrupted connectivity between users.

Conclusion

Tally Prime is a reliable and practical accounting solution for UAE businesses and accountants. Its simplicity, strong VAT compliance features, integrated inventory management, and powerful reporting make it suitable for SMEs, trading companies, and professional accounting firms.

When set up correctly and used efficiently, Tally Prime helps reduce errors, improve compliance, and save valuable time during reporting and audits.

For UAE accountants, mastering Tally Prime is not just a technical skill, it is a professional advantage that supports accurate reporting, client trust, and business growth.