UAE VAT Amendments 2026 Explained for Tally Prime Users

UAE VAT amendments 2026 simplify reverse charge rules and set refund time limits. Here is what UAE businesses using Tally Prime must know.

The UAE has announced VAT law amendments effective from 1 January 2026.

Headlines talk about simplification and flexibility, but what really matters is how this changes daily VAT work inside your business.

If you issue invoices, deal with imports, apply reverse charge, or reconcile VAT in Tally Prime, these changes matter.

This guide explains exactly what changed, who is affected, and what you should do next in Tally Prime, without legal language or confusion.

What the UAE VAT amendments 2026 actually mean in simple words

The key VAT change is about reverse charge and VAT recovery timelines.

Two important updates:

- Self invoices are no longer mandatory under reverse charge, as long as proper documents are maintained

- A five year time limit is introduced to claim excess refundable VAT

This does not remove VAT responsibility. It changes how proof and timing are handled.

Who in the UAE is affected by these VAT changes

These amendments mainly affect:

- Trading companies importing goods

- Businesses buying services from overseas suppliers

- Companies using reverse charge VAT

- Businesses that often have excess VAT credit

- Accounts teams managing VAT returns in Tally Prime

If your VAT return includes import VAT, RCM entries, or VAT refunds, this applies to you.

Real life UAE business scenario

Before 2026

A UAE company receives a service invoice from a foreign supplier.me to document accuracy.

Under reverse charge:

- They record VAT

- They create a self invoice

- They worry whether missing the self invoice may cause issues later

Many businesses skipped self invoices or created incorrect ones, causing confusion during VAT audits.

From 1 January 2026

If the business:

- Keeps supplier invoices

- Maintains contracts or payment proof

- Records VAT correctly in accounting

Then issuing a separate self invoice is not mandatory.

The focus shifts from paperwork volume to document accuracy.

How UAE VAT amendments 2026 impact Tally Prime usage

This change does not mean you stop reverse charge entries in Tally.

It means you must record them correctly, without relying on dummy invoices.

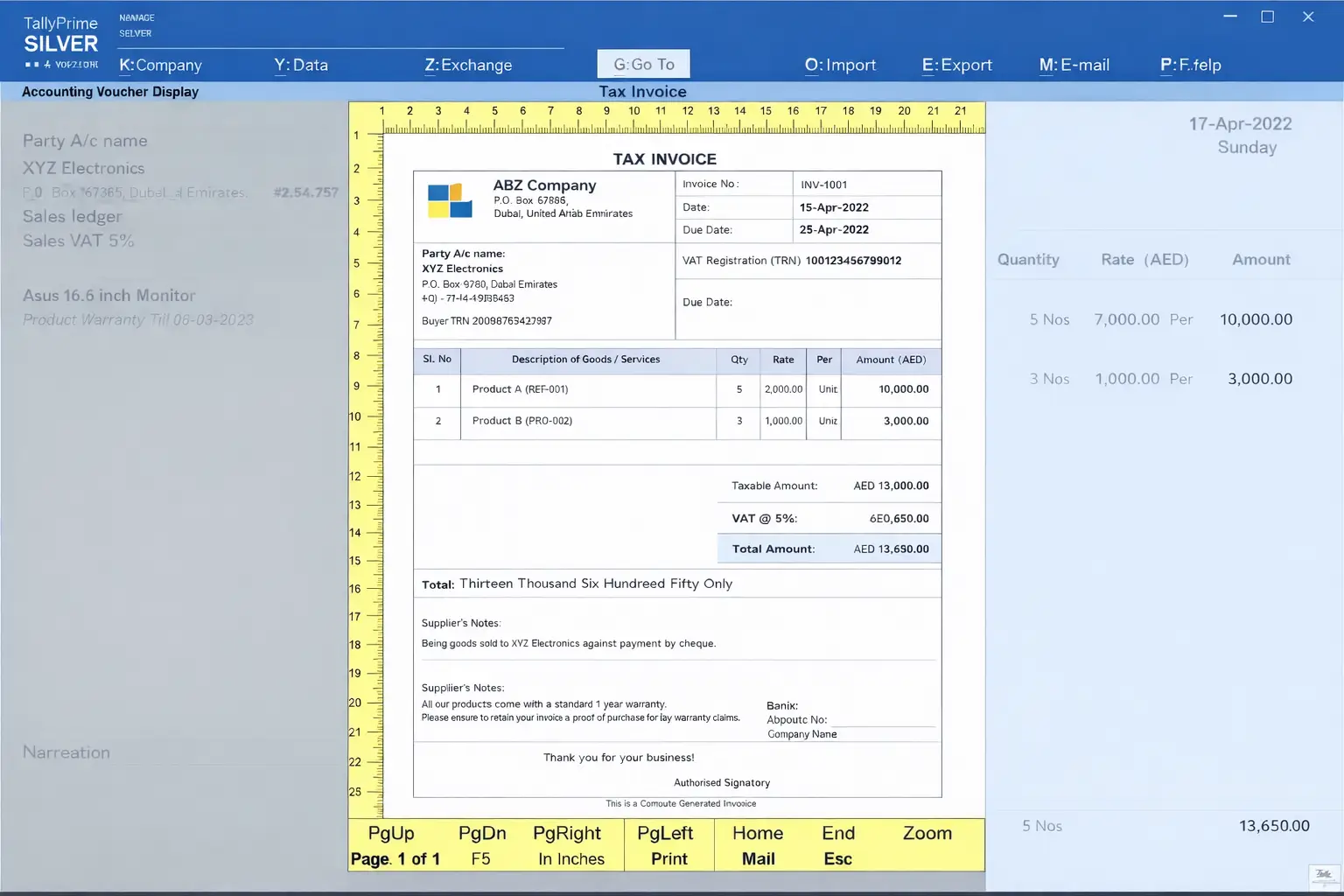

Key points for Tally Prime users

• Reverse charge VAT still applies

• VAT calculation logic does not change

• Documentation becomes more important than invoice format

• Incorrect ledger classification will still cause VAT errors

Tally Prime remains your main compliance tool.

What you should check in Tally Prime now

1. Reverse charge ledger setup

Ensure:

• Correct VAT classification

• Reverse charge enabled where applicable

• Proper expense or purchase ledger usage

Wrong classification will still create wrong VAT returns.

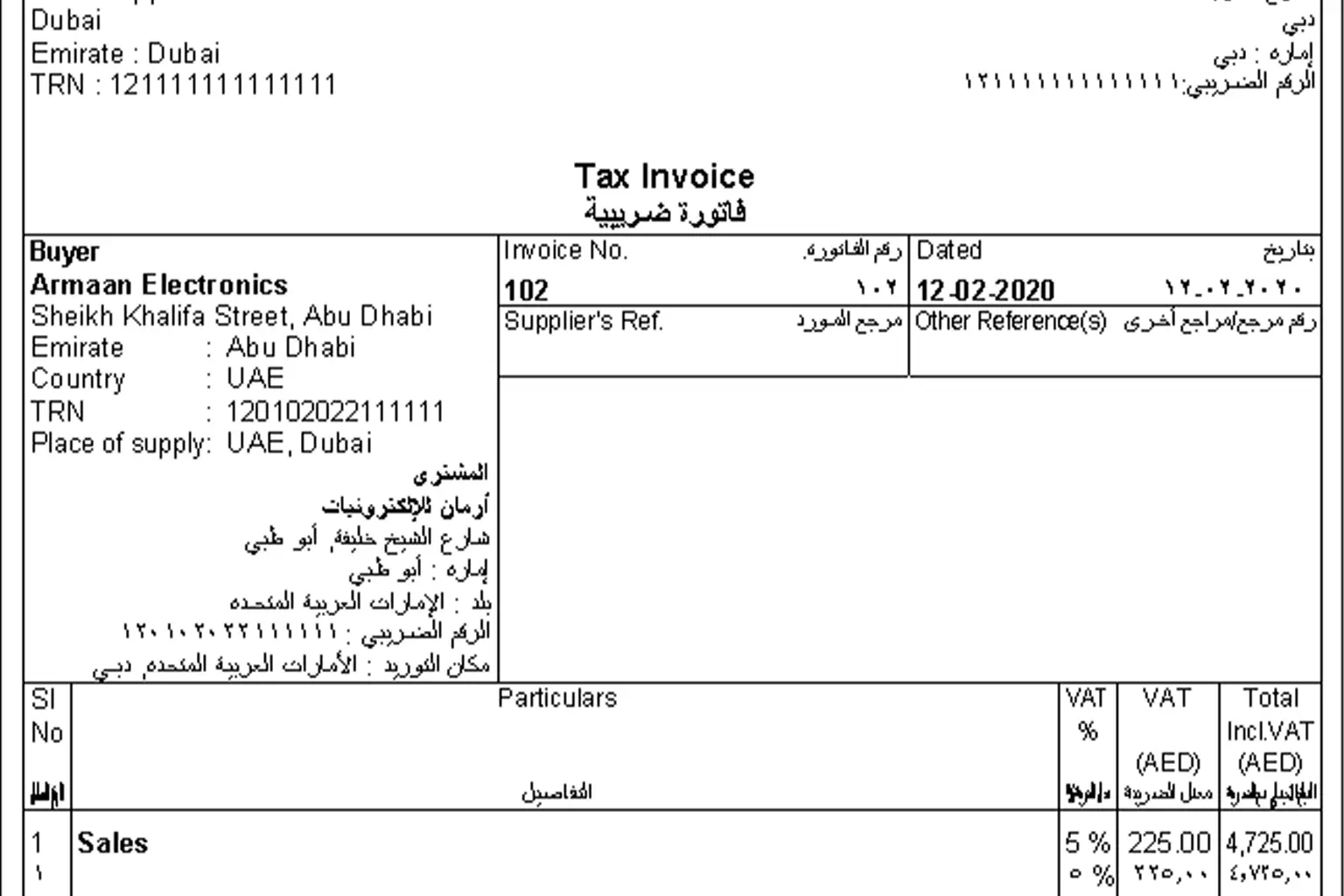

2. Supporting documents discipline

Since self invoices are optional now, businesses must ensure:

• Supplier invoices are stored

• Contracts or agreements are available

• Payment records match accounting entries

Tally entries without backup documents are still risky.

3. VAT refund tracking inside Tally

The new five year limit means:

• Old excess VAT cannot be claimed forever

• Reconciliation delays may cost real money

Use Tally reports to:

• Track VAT credit balances

• Identify pending refundable VAT

• Avoid losing claim eligibility due to time lapse

Common mistakes UAE businesses may make

• Assuming reverse charge is removed completely

• Stopping VAT entries for overseas services

• Ignoring documentation just because self invoices are not needed

• Forgetting about old excess VAT balances

• Treating this as a software change instead of a compliance change

These mistakes can still trigger FTA issues.

What UAE businesses should do now, practical steps

- Review all reverse charge related ledgers in Tally Prime

- Verify VAT classification for overseas suppliers

- Create a document storage habit linked to transactions

- Review excess VAT balances year by year

- Plan VAT reconciliations regularly, not once a year

No urgent panic, but early preparation avoids future pressure.

Final clarity for UAE business owners

The UAE VAT amendments 2026 are not about adding complexity.

They are about clarity and responsibility.

Less paperwork does not mean less control.

It means the FTA expects clean records and correct accounting.

If your Tally Prime data is accurate, these changes actually make compliance easier.